Global Financial Crisis (5 Viewers)

- Thread starter Dostoevsky

- Start date

More options

Who Replied?Porter Stansberry from Stansberry Research created this interesting video. I like this guy because his team is filled with analysts who are not affiliated with any banking institution, brokerage, or bullion dealer. So his employees actually come to him because he allows them to write what they feel is correct instead of being forced to talk a book. Worth a look.

http://www.stansberryresearch.com/pro/1011PSIENDVD/EPSIM116/PR

http://www.stansberryresearch.com/pro/1011PSIENDVD/EPSIM116/PR

Global Elite: Shrinking the Middle Class Is For Greater Good

http://www.theatlantic.com/magazine/archive/2011/01/the-rise-of-the-new-global-elite/8343/1/

We can see where this is going. These same folks also take jobs in CONgress and other places in the government. They don't care about you, that's for sure.

The U.S.-based CEO of one of the world’s largest hedge funds told me that his firm’s investment committee often discusses the question of who wins and who loses in today’s economy. In a recent internal debate, he said, one of his senior colleagues had argued that the hollowing-out of the American middle class didn’t really matter. “His point was that if the transformation of the world economy lifts four people in China and India out of poverty and into the middle class, and meanwhile means one American drops out of the middle class, that’s not such a bad trade,” the CEO recalled."

"I heard a similar sentiment from the Taiwanese-born, 30-something CFO of a U.S. Internet company. A gentle, unpretentious man who went from public school to Harvard, he’s nonetheless not terribly sympathetic to the complaints of the American middle class. “We demand a higher paycheck than the rest of the world,” he told me. “So if you’re going to demand 10 times the paycheck, you need to deliver 10 times the value. It sounds harsh, but maybe people in the middle class need to decide to take a pay cut.”"

"I heard a similar sentiment from the Taiwanese-born, 30-something CFO of a U.S. Internet company. A gentle, unpretentious man who went from public school to Harvard, he’s nonetheless not terribly sympathetic to the complaints of the American middle class. “We demand a higher paycheck than the rest of the world,” he told me. “So if you’re going to demand 10 times the paycheck, you need to deliver 10 times the value. It sounds harsh, but maybe people in the middle class need to decide to take a pay cut.”"

We can see where this is going. These same folks also take jobs in CONgress and other places in the government. They don't care about you, that's for sure.

Global Elite: Shrinking the Middle Class Is For Greater Good

http://www.theatlantic.com/magazine/archive/2011/01/the-rise-of-the-new-global-elite/8343/1/

We can see where this is going. These same folks also take jobs in CONgress and other places in the government. They don't care about you, that's for sure.

http://www.theatlantic.com/magazine/archive/2011/01/the-rise-of-the-new-global-elite/8343/1/

We can see where this is going. These same folks also take jobs in CONgress and other places in the government. They don't care about you, that's for sure.

Former LA Mayor: 90% Of Cities/States Bankrupt In 5 Years

“Throughout the country, 90 percent of cities and states are going to go bankrupt within the next five years, many of them sooner.” So says former Los Angeles Mayor Richard Riordan.

Reason.tv’s Tim Cavanaugh sat down with Riordan to discuss state and local budget crises, public-sector unions, and why Riordan recently became a fan of current LA Mayor Antonio Villaraigosa.

Reason.tv’s Tim Cavanaugh sat down with Riordan to discuss state and local budget crises, public-sector unions, and why Riordan recently became a fan of current LA Mayor Antonio Villaraigosa.

Here's another one for you Andy; If the country lacks the cash let it be crime!

http://www.bbc.co.uk/news/uk-wales-12225659

http://www.bbc.co.uk/news/uk-wales-12225659

Very interesting analysis:

http://market-ticker.org/cgi-ticker/akcs-www?post=177912

http://market-ticker.org/cgi-ticker/akcs-www?post=177912

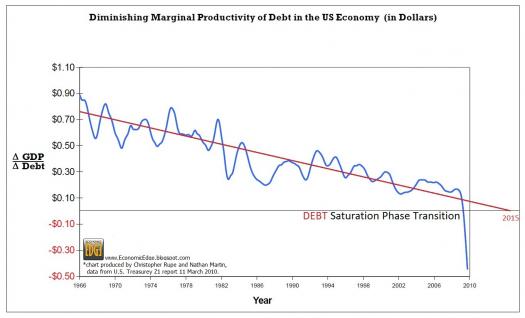

There has been NO actual positive GDP growth during the entire period from 1953 onward – until the 4th quarter of 2009, and since 1980 the true GDP numbers, when one looks at output (not what one “pulls forward” via debt) has been hideously bad. The spike upward in actual debt-adjusted growth that began in the 4th quarter of 2009 and peaked in the 1st quarter of 2010 was due to total systemic debt reduction – the very thing the government is trying to prevent, but which is necessary to bring the economy back into balance.

This, incidentally, is why median incomes haven’t moved upward at all in the last decade and why it seems to be harder and harder every year to maintain a middle-class lifestyle - and has been since the 1950s. The loss of purchasing power in real terms, the drive to “two income” households and finally the wild screams from the media, government, and lastly Bernanke’s recent assertion that “QE2” has been a “success” because the stock market has gone up all underlie the truth – we have not grown the economy at all during the last sixty years! Instead we serially pulled out the credit card and said “Charge It!”, continually rolling over the debt and adding more to it.

If you look at the stock market, one has to ask – when did it start to “take off”? In 1991 the S&P 500 printed 300 and the Dow stood at 2,500. That was the start of the monstrous "bull run" in stocks.

Exactly none of the alleged “stock market appreciation” has come from actual economic growth since that time. It has all come from ever-increasing amounts of leverage (debt) that, when subtracted back out of the change in GDP, show that on an actual output basis the economy of the United States has not printed a positive number the entire time.

Nobody in the media – or government – will talk about this, despite the fact that the there’s little room for argument on the mathematical facts – they’re right there in the government data.

This, incidentally, is why median incomes haven’t moved upward at all in the last decade and why it seems to be harder and harder every year to maintain a middle-class lifestyle - and has been since the 1950s. The loss of purchasing power in real terms, the drive to “two income” households and finally the wild screams from the media, government, and lastly Bernanke’s recent assertion that “QE2” has been a “success” because the stock market has gone up all underlie the truth – we have not grown the economy at all during the last sixty years! Instead we serially pulled out the credit card and said “Charge It!”, continually rolling over the debt and adding more to it.

If you look at the stock market, one has to ask – when did it start to “take off”? In 1991 the S&P 500 printed 300 and the Dow stood at 2,500. That was the start of the monstrous "bull run" in stocks.

Exactly none of the alleged “stock market appreciation” has come from actual economic growth since that time. It has all come from ever-increasing amounts of leverage (debt) that, when subtracted back out of the change in GDP, show that on an actual output basis the economy of the United States has not printed a positive number the entire time.

Nobody in the media – or government – will talk about this, despite the fact that the there’s little room for argument on the mathematical facts – they’re right there in the government data.

Bill Gross: Treasuries are worth little

http://www.pimco.com/Pages/skunked.aspx

More analysis:

http://market-ticker.org/cgi-ticker/akcs-www?post=183431

Bill Gross runs the largest Bond investment fund in the world. Folks keep warning of this, yet nobody pays any attention to simple mathematical fact. Washington can't even agree to cut 50B in spending. This road doesn't end well, and anybody who tells you otherwise is lying.

http://www.pimco.com/Pages/skunked.aspx

Medicare, Medicaid and Social Security now account for 44% of total federal spending and are steadily rising.

Previous Congresses (and Administrations) have relied on the assumption that we can grow our way out of this onerous debt burden.

Unless entitlements are substantially reformed, the U.S. will likely default on its debt; not in conventional ways, but via inflation, currency devaluation and low to negative real interest rates.

Previous Congresses (and Administrations) have relied on the assumption that we can grow our way out of this onerous debt burden.

Unless entitlements are substantially reformed, the U.S. will likely default on its debt; not in conventional ways, but via inflation, currency devaluation and low to negative real interest rates.

http://market-ticker.org/cgi-ticker/akcs-www?post=183431

Put an actual plan on the table to do that and pass it, or kiss this nation's debt-issuing capability goodbye at a time of our creditors' choosing, not ours. Such an event will cause a dislocation in government entitlements and the economy that will make September and October of 2008 look like a Girl Scout picnic and you will have no tools with which to address it.

--

Smartest thing was said a couple of weeks ago. One guy was asked about crisis and when does he think it will end, he said "nobody knows". It's very accurate and judging by these pictures it just can't be any time soon because it's impossible. Unless they think of some new theory it will last for years and years.

If our government let all the insolvent banks go belly up in 2008 and all the bad debt was cleared from the system, the US would be in the clear now. But just as all governments do, they choose the easy option instead of the right one. So the Ponzi games continue... until they can't.

Wait, what do you mean? Did the US government force FED to make money and use it to pay debts that banks had?

Of course, it didn't matter that Paulson ran the bailout fund after being on the board of directors for Goldman Sachs. I'm sure he had no interest, whatsoever, in the firm after he departed for his glorious job as a Trojan Horse.

Cheers.

--

Oh God, so much bullshit. We're the worst country in the region when you look at the average wages. Not only that, but our debts are huge and not only THAT but we're the only country next to Spain who's unemployment rate is over 19% at the moment. While of course our inflation rate is too much and for example 9 times higher than in Croatia.

Yet again those idiots from IMF (I'm still sure their aim is to destroy any given country as it's their task) said how we'll have the highest GDP next year. No, not in the region but in freakin' EUROPE! God, and people even believe their comments

--

Oh God, so much bullshit. We're the worst country in the region when you look at the average wages. Not only that, but our debts are huge and not only THAT but we're the only country next to Spain who's unemployment rate is over 19% at the moment. While of course our inflation rate is too much and for example 9 times higher than in Croatia.

Yet again those idiots from IMF (I'm still sure their aim is to destroy any given country as it's their task) said how we'll have the highest GDP next year. No, not in the region but in freakin' EUROPE! God, and people even believe their comments

Very bad news for people who use commodities on a daily basis (everyone).

The US Dollar index just broke through its 2009 lows and will probably head towards the last support level of 71, or rather the 2008 and historical lows. After that, there isn't any support on the chart.

What happened last time the Dollar Index was in this territory? Oil was $147 per barrel, and all other commodities including natural gas and agricultural commodities that you eat ramped as well. Then after a few months of skyrocketing prices, Western economies started to crash because consumers and companies alike could not manage the hit to their books in an already credit-strained scenario.

So now here we are again with commodity prices already up 30 to 100% over the course of the last year, margins of companies are being crushed, and the consumer has their backs up against the wall because of this stupid Federal Reserve debt monetization. Ben Bernanke's shenanigans of buying up our own Treasuries to fund the federal deficit and debase the currency is going to destroy whatever was left of this economy. If he doesn't stop this nonsense now and pull liquidity (which would crash the markets), these prices will only go higher, making the eventual crash even worse.

Commodity prices going higher has already had a major global impact over the past few months, with civil unrest spreading throughout the Arab world partly because they can't afford basic living supplies anymore.

There is no free lunch in economics, even if you can print your own currency.

The US Dollar index just broke through its 2009 lows and will probably head towards the last support level of 71, or rather the 2008 and historical lows. After that, there isn't any support on the chart.

What happened last time the Dollar Index was in this territory? Oil was $147 per barrel, and all other commodities including natural gas and agricultural commodities that you eat ramped as well. Then after a few months of skyrocketing prices, Western economies started to crash because consumers and companies alike could not manage the hit to their books in an already credit-strained scenario.

So now here we are again with commodity prices already up 30 to 100% over the course of the last year, margins of companies are being crushed, and the consumer has their backs up against the wall because of this stupid Federal Reserve debt monetization. Ben Bernanke's shenanigans of buying up our own Treasuries to fund the federal deficit and debase the currency is going to destroy whatever was left of this economy. If he doesn't stop this nonsense now and pull liquidity (which would crash the markets), these prices will only go higher, making the eventual crash even worse.

Commodity prices going higher has already had a major global impact over the past few months, with civil unrest spreading throughout the Arab world partly because they can't afford basic living supplies anymore.

There is no free lunch in economics, even if you can print your own currency.

Attachments

-

42.5 KB Views: 4

Cheers.

--

Oh God, so much bullshit. We're the worst country in the region when you look at the average wages. Not only that, but our debts are huge and not only THAT but we're the only country next to Spain who's unemployment rate is over 19% at the moment. While of course our inflation rate is too much and for example 9 times higher than in Croatia.

Yet again those idiots from IMF (I'm still sure their aim is to destroy any given country as it's their task) said how we'll have the highest GDP next year. No, not in the region but in freakin' EUROPE! God, and people even believe their comments

--

Oh God, so much bullshit. We're the worst country in the region when you look at the average wages. Not only that, but our debts are huge and not only THAT but we're the only country next to Spain who's unemployment rate is over 19% at the moment. While of course our inflation rate is too much and for example 9 times higher than in Croatia.

Yet again those idiots from IMF (I'm still sure their aim is to destroy any given country as it's their task) said how we'll have the highest GDP next year. No, not in the region but in freakin' EUROPE! God, and people even believe their comments

Obama officials tried to keep S&P rating at 'stable’

http://www.washingtonpost.com/busin...ting_at_stable/2011/04/19/AFfAeO8D_story.html

Good job by S&P to ignore these clowns.

The Obama administration privately urged Standard & Poor’s in recent weeks not to lower its outlook on the United States — a suggestion the ratings agency ignored Monday, two people familiar with the matter said.

Treasury Department officials had been discussing with S&P whether the ratings agency should change its outlook on the United States to “negative” from “stable,” an indication that the country could lose its crucial AAA rating in coming years over its soaring debt levels.

Treasury officials told S&P analysts that they were underestimating the ability of politicians in Washington to fashion a compromise to curb deficits, a Treasury official said. They argued a change in ratings was not needed at this time because the debt was manageable and the administration had a viable plan in the works, the official said.

But S&P analysts told Treasury officials on Friday that they were unmoved — and released a report that expressed skepticism that the political parties could come together on how to bring spending in line with revenue.

Any doubts by credit rating agencies about government debt has the potential to increase borrowing costs for the Treasury.

Treasury Department officials had been discussing with S&P whether the ratings agency should change its outlook on the United States to “negative” from “stable,” an indication that the country could lose its crucial AAA rating in coming years over its soaring debt levels.

Treasury officials told S&P analysts that they were underestimating the ability of politicians in Washington to fashion a compromise to curb deficits, a Treasury official said. They argued a change in ratings was not needed at this time because the debt was manageable and the administration had a viable plan in the works, the official said.

But S&P analysts told Treasury officials on Friday that they were unmoved — and released a report that expressed skepticism that the political parties could come together on how to bring spending in line with revenue.

Any doubts by credit rating agencies about government debt has the potential to increase borrowing costs for the Treasury.

Good job by S&P to ignore these clowns.