The Financial Situation (31 Viewers)

- Thread starter ReBeL

- Start date

More options

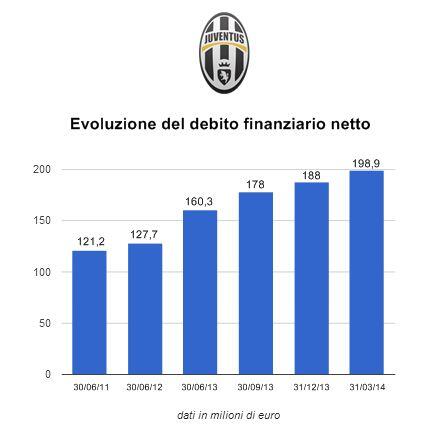

Who Replied?We recorded profit after the 3rd quarter in amount of 2.9m. It's decrease of 70% compared to the same time last year, when we recorded 11m. Overall debt increased to 198m, last year it was 160m...

Revenues 229.2 m

Operating costs 171.6m

Amortization 43.7 m

Operating income 13.9 m

Net income 2.9m

http://www.juventus.com/wps/wcm/con...&CACHEID=d59011cf-5bb2-446e-ba2e-298845bee866

http://www.tuttojuve.com/primo-pian...ugno-perdite-superiori-ai-16-mln-con-r-189460

Revenues 229.2 m

Operating costs 171.6m

Amortization 43.7 m

Operating income 13.9 m

Net income 2.9m

http://www.juventus.com/wps/wcm/con...&CACHEID=d59011cf-5bb2-446e-ba2e-298845bee866

http://www.tuttojuve.com/primo-pian...ugno-perdite-superiori-ai-16-mln-con-r-189460

I don't understand how our debt increased last year... but one thing is for sure... our debt is increasing less and less...

Also: Our Equity increased this year aswell... so the debt/equity ratio is still the same.. a business shouldn't be financed with only debt.. but it also shouldn't be financed with only equity

Also: Our Equity increased this year aswell... so the debt/equity ratio is still the same.. a business shouldn't be financed with only debt.. but it also shouldn't be financed with only equity

I don't understand how our debt increased last year... but one thing is for sure... our debt is increasing less and less...

Also: Our Equity increased this year aswell... so the debt/equity ratio is still the same.. a business shouldn't be financed with only debt.. but it also shouldn't be financed with only equity

Also: Our Equity increased this year aswell... so the debt/equity ratio is still the same.. a business shouldn't be financed with only debt.. but it also shouldn't be financed with only equity

You need to look at the end of each year, as that chart shows quarters as well.

As for the equity we'll record loss at the end of FY, significant probably, and it will decrease.

Having equity on a healthy levels is one of the requirements of being able to meet due obligations. If you're solely dependent on debt and most importantly if you rely on short term loans, you're risking a situation to become insolvent. This model in unsustainable in the long run as banks might threaten to convert part of the debt into equity, practically becoming owners of the legal entity. Fiat among many others had that particular issue at the beginning of the millennium, but they avoided it by forming an alliance with Crysler. Roma few years ago, before the American investors took over, had the difficulties to pay salaries to their personnel and you could have read that players like Emerson complained for not having received salaries for more than 6 months. For this reason I believe Exxor might very soon increase our capital reserves.

@Zacheryah

I said what my expectations are before, but I might have been little too optimistic and following our general trend, but we'll see. As for our funds, it seems to me that 15-20m is what we can afford and without another loan, that would increase our debt further, we won't spend much. This basically depends on the board and decision they make. I can only guess which action they will decide to take.

To summarize it I hope that we take 30-40m loan and use 15-20 of our funds. That would allow us to have great mercato, but also expose us to more risk, which will be reduced next summer when the new sponsors kick in. Can't be more precise on that.

I said what my expectations are before, but I might have been little too optimistic and following our general trend, but we'll see. As for our funds, it seems to me that 15-20m is what we can afford and without another loan, that would increase our debt further, we won't spend much. This basically depends on the board and decision they make. I can only guess which action they will decide to take.

To summarize it I hope that we take 30-40m loan and use 15-20 of our funds. That would allow us to have great mercato, but also expose us to more risk, which will be reduced next summer when the new sponsors kick in. Can't be more precise on that.

@Zacheryah

I said what my expectations are before, but I might have been little too optimistic and following our general trend, but we'll see. As for our funds, it seems to me that 15-20m is what we can afford and without another loan, that would increase our debt further, we won't spend much. This basically depends on the board and decision they make. I can only guess which action they will decide to take.

To summarize it I hope that we take 30-40m loan and use 15-20 of our funds. That would allow us to have great mercato, but also expose us to more risk, which will be reduced next summer when the new sponsors kick in. Can't be more precise on that.

I said what my expectations are before, but I might have been little too optimistic and following our general trend, but we'll see. As for our funds, it seems to me that 15-20m is what we can afford and without another loan, that would increase our debt further, we won't spend much. This basically depends on the board and decision they make. I can only guess which action they will decide to take.

To summarize it I hope that we take 30-40m loan and use 15-20 of our funds. That would allow us to have great mercato, but also expose us to more risk, which will be reduced next summer when the new sponsors kick in. Can't be more precise on that.

So around 45-60m, I think that makes sense and since we are going to get rid of deadwood maybe we could add like another 15m or so.

On the other hand, 6 months ago people were certain we had to sell Pogba and maybe Vidal to cope with the losses.

Same people demanding "an efford" from the board now.